If the current and/or future assets you are expecting to use for the property purchase and/or mortgage repayments are held in different currencies, financial planning becomes difficult. The challenges can be split into two main areas:

- Exchange rate risk: sudden changes in the currency markets could mean significant movements in the exchange rates between different currencies. Adverse movements may have a consequent impact on bottom-line of your intended purchase or sale.

- Price risk: the actual exchange rate you receive, commissions and/or transfer costs all make a difference to the total cost of the transaction to you.

This article will look at both of these areas and explain with some straightforward examples how you can calculate different options and identify the best deal.

Exchange rate risk

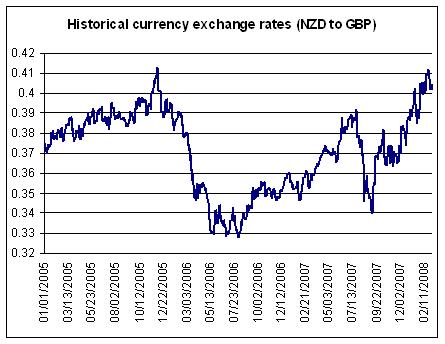

Like most markets, the currency market is prone to periods of instability and readjustment. Just because the exchange rate between a pair of different currencies has been stable for many months, there is no reason to assume it will be the case tomorrow. For an idea of the scale of possible movement, just look at the New Zealand Dollar expressed in British Pounds below:

Large swings have the most immediate and obvious impact when talking about large sums of money.

For example, you agreed to buy a townhouse in Auckland for $800,000 in mid-2007 with a completion date for the purchase in March 2008. It may have cost GBP 305,000 when you agreed to buy the property, but GBP 322,000 when you needed to complete the purchase.

In this example period the New Zealand Dollar strengthened against the Pound. The opposite can take place, and you ‘win’ in the currency movement. However, many people don’t regard themselves to be currency traders and have a preference for less risk and a more certain outcome. So, what options do you have in order to limit these currency movements? :

- Transfer the whole amount today. Advantages: you lock in the current exchange rate and get certainty over the exchange rate. Disadvantages: you might not have all of the cash to make the transfer or the interest you earn in the foreign currency may be less than you are currently earning on the money.

- Buy a ‘Forward Exchange Contract (FEC)’ to lock in an exchange rate. Advantages: you get a guaranteed rate in the future without having to pay all of money up-front. Disadvantages: there is a principle payment to make and you are obliged to complete on the deal and pay commissions.

- Speak to a Foreign Exchange Specialist: Advantages: you may be able to time your purchase or sale better and thus save. Disadvantages: They can’t always predict the future but all information helps make a more informed decision.

Price risk

This is the real risk that your bank or another money transfer agent will quote you an uncompetitive exchange rate with an extremely wide spread! It is common practice for bank foreign exchange departments to quote their retail customers exchange rates that are significantly worse than the current spot price in the market.

You will often see an exchange rate price between two currencies on the news and in some exchange rate tables, online services, etc. This will be the mid market ‘Interbank Rate or Spot Price’ and is more or less the indicative level where banks and financial institutions trade the currency. In banks and currency exchange bureau you will see exchange rates quoted with very different buy and sell prices. The (spread) is the difference between the Spot price and the price that they quote to you.

Some people get surprised when they make a calculation on the basis of the rate they find in the newspaper and then find out their transfer has cost them a lot more. Typically, you will get the worst exchange rates in airports and bureaux d’echange in tourist areas. Online money transfer providers, such as PayPal, sometimes have cheap or no costs for making the transfer, but then use an exchange rate with a large spread. High-street banks do not often offer very good deals when it comes to money transfer, often applying less favourable exchange rates to their private individual customers. Usually the best deal you can get will be from a currency exchange specialist, although not all of them deal with small retail transactions.

You can break price risk into three different components:

- Spread (Margin) – the difference between the Spot exchange rate and the buy price you are quoted.

- Commission – the cost applied for the exchange, this will be a percentage of the transaction or a flat fee.

- Transfer costs – the cost applied to make the transfer out of the exchanged currency.

Most providers will not charge all of these elements, but it is important to take into account their impact when making a calculation. For example, one provider may appear to have a better deal but that provider may charge a GBP 10 transfer charge, while another provider offering a higher rate has no additional charges. Working out the difference between the two can save you money.

Some tips

- Shop around

- Make sure you understand when you need to exchange your money and make a plan to see how changes in rates could affect you

- Talk to specialists: many will be willing to listen to your requirements and suggest how to best meet them on a non-obligation basis. Unlike high-street banks, they tend to have a more personal and results-oriented approach.

By Peter Filmer, Exchange4Free

We offer the best rates, no commissions, no transfer fees and great advice. Get in touch!

Tel. UK: 0845 652 1022

Tel. International: +44 208 150 1941

http://www.exchange4free.co.uk